Mobile accounted for almost 80 per cent of programmatic spend in China last year

- Tuesday, January 23rd, 2018

- Share this article:

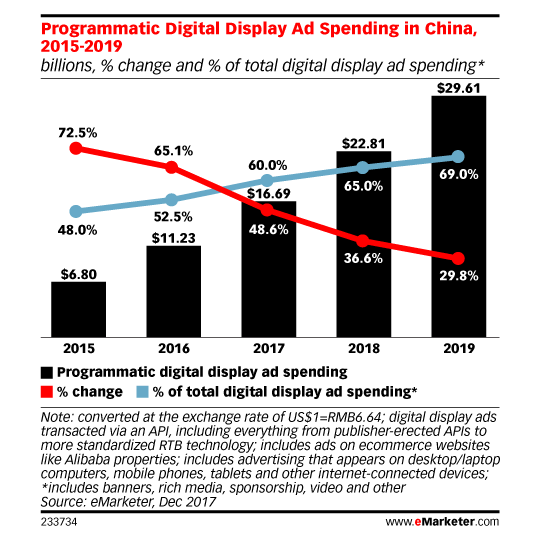

Programmatic spending in China has surged over the past year, increasing by 48.6 per cent year-on-year to hit a total of $16.7bn (£11.9bn) in 2017, according to new figures from eMarketer.

Programmatic spending in China has surged over the past year, increasing by 48.6 per cent year-on-year to hit a total of $16.7bn (£11.9bn) in 2017, according to new figures from eMarketer.

Spending was driven by local internet giants like Baidu, Alibaba and Tencent, who are expected to continue to dominate the programmatic ad landscape. The so-called BAT companies cast a large shadow over digital publishing in the region, with most advertisers buying directly through one of the BAT companies.

As a result, direct sales accounted for 63.5 per cent of programmatic digital display ad spending last year, compared to just 36.5 per cent through real-time bidding.

With many Chinese consumers considered mobile-first, digital advertisers in the region have followed suit, with 79.9 per cent of programmatic spend dedicated to mobile advertising, and mobile expected to keep driving total programmatic growth.

Despite this rapid growth, programmatics share of overall display ad spending in China lags behind the US and the UK, at 60 per cent, compared to 78 per cent and 79 per cent respectively. This is largely due to the limited options available to advertisers in China, compared to the more competitive spread of publishers in the US and UK, which enables more spending.

eMarketers forecast for the region predicts that growth will continue to slow over the next few years but will remain healthy, dropping to 36.6 per cent this year, and 29.8 per cent in 2019. By 2019, programmatic is expected to account for 69 per cent of all digital display ad spending, with spending of around $29.6bn.