data.ai rounds off 2022 with three important product innovations

- Tuesday, December 13th, 2022

- Share this article:

Lexi Sydow, Head of Insights at data.ai, explains how three new innovations from the company can help developers monetize their apps more effectively.

As we close off 2022, data.ai has introduced three important additions to our offering to help developers monetize their apps more successfully.

As we close off 2022, data.ai has introduced three important additions to our offering to help developers monetize their apps more successfully.

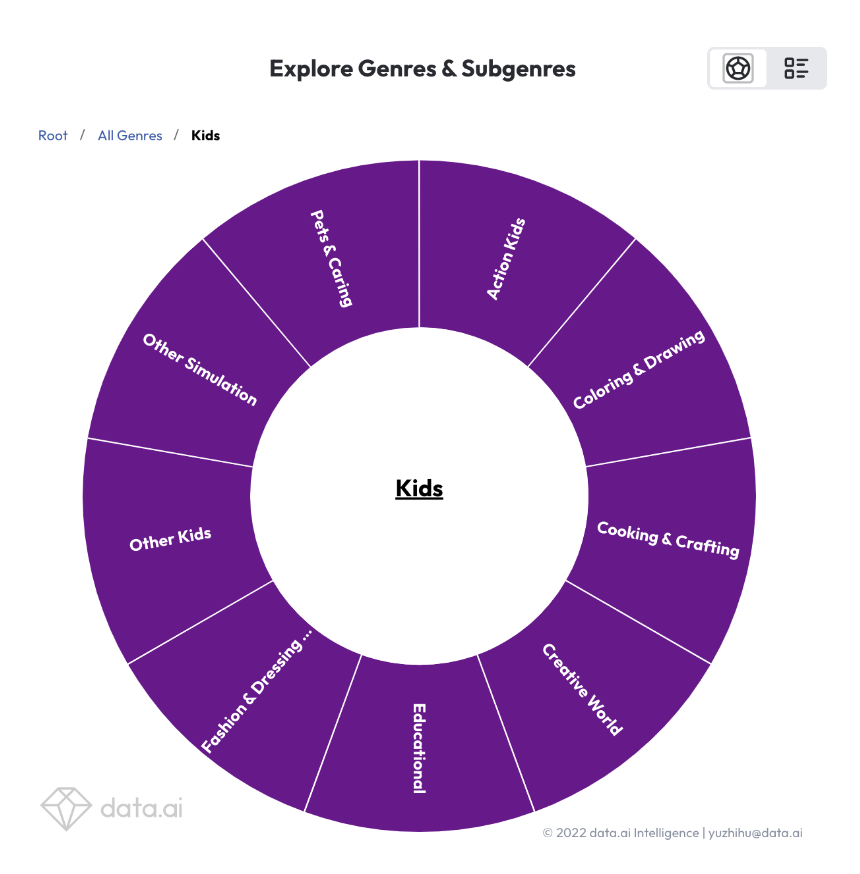

The first is the introduction of a Kids Genre classification, with several underlying subgenres, as part of our Game IQ game analytics and classification platform

Games for kids are games designed with education at the forefront. They contain bright colours, cheerful music and fewer or limited opportunities to monetize. To grow a game in this space , developers need to have an understanding of the features that are helping to drive new user acquisition and retention. It’s important to understand how to appeal to both the kid who will play the game and the parents who will download it.

To help developers discover the potential competitors and fit into the changing market, data.ai divided kids games into following subgenres: Action Kids; Coloring & Drawing; Cooking & Crafting; Creative World; Educational; Fashion & Dressing Up; Pets & caring’ Other Simulation; and Other Kids. Each of these subgenres contains unique data points that point towards what’s driving success for younger gamers.

To help developers discover the potential competitors and fit into the changing market, data.ai divided kids games into following subgenres: Action Kids; Coloring & Drawing; Cooking & Crafting; Creative World; Educational; Fashion & Dressing Up; Pets & caring’ Other Simulation; and Other Kids. Each of these subgenres contains unique data points that point towards what’s driving success for younger gamers.

With the introduction of this Game IQ taxonomy enhancement, the number of data.ai’s game genres has reached 15. In the data as of early September 2022, we can see that the new Kids genre is in the top 10 of all genres in both revenue and downloads. Kids overall is the 4th out of 15 genres in terms of downloads.

Monetizing kids games

Yet while the Kids genre excels in downloads it is significantly underrepresented in overall revenue. What is the reason for this? Many kids games don’t monetize as aggressively as apps targeted to older demographics. In order to create a profitable game for children, different monetization strategies need to be tested and evaluated. Advertising revenue, paid downloads and subscriptions are key for driving revenue when frequent IAPs (In-App-Purchases) are not possible.

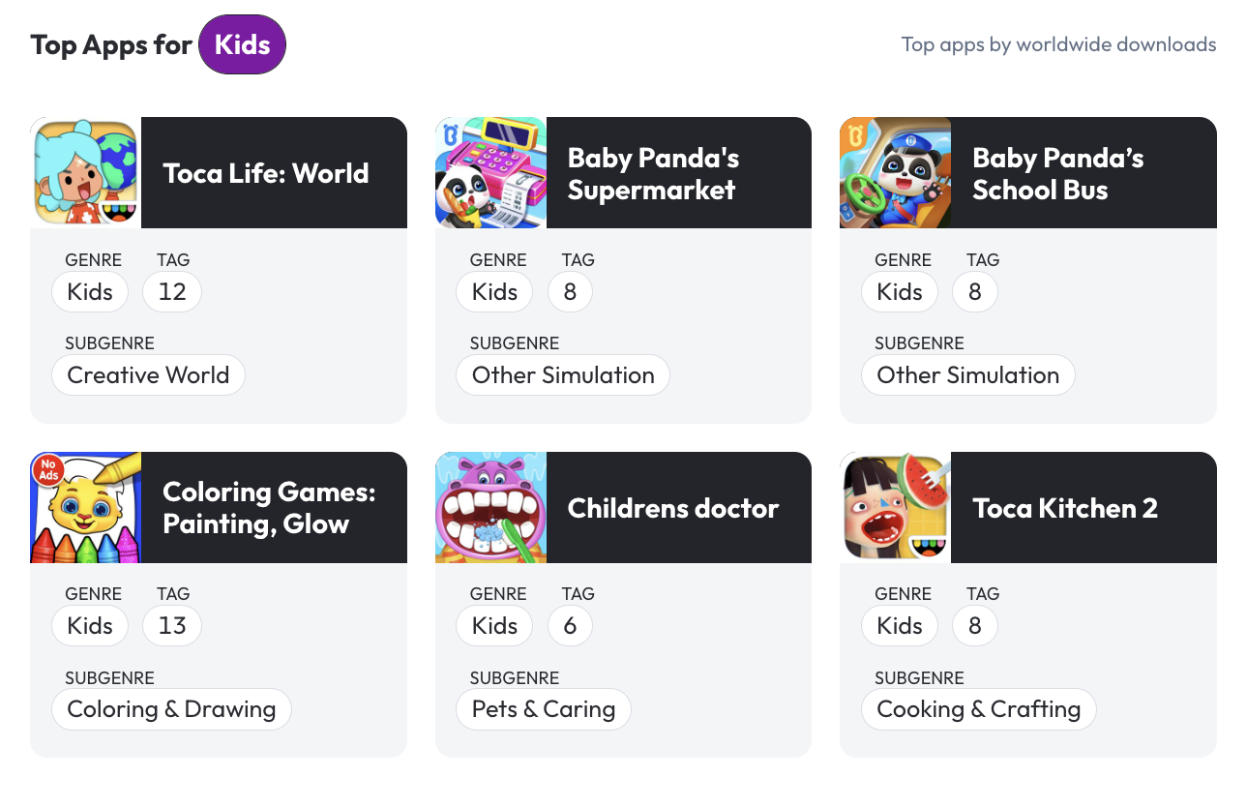

data.ai is opening up the kids genre as a way to dig into who is driving growth in this unique subset of mobile games, and how they are getting around the particular challenges of this demographic. So who is winning in this genre? And how are they doing it?

Many of these games afford kids the opportunity to tell their own story through gameplay. These games provide the player with a large map, and all the gamers operations revolve around this map: players can unlock and build various functional buildings (gardens, cinemas, etc.) in the open spaces on this map, and they can also enter these buildings, and transform the scenes in these buildings with cosmetic items and decorations. We summarize these games focused on creating, building, or making stories in a relatively open world as Kids – Creative World.

Toca Life: World is one of the most typical examples of Creative World games. This subgenre stands atop the kids genre in driving revenue, and the games within it are continuously optimizing their purchase funnel. Looking at the biggest movers for downloads and revenue within this subgenre, we can see that Baby Panda World and Yoya Busy Life World are also improving their acquisition and monetization.

Toca Life: World is one of the most typical examples of Creative World games. This subgenre stands atop the kids genre in driving revenue, and the games within it are continuously optimizing their purchase funnel. Looking at the biggest movers for downloads and revenue within this subgenre, we can see that Baby Panda World and Yoya Busy Life World are also improving their acquisition and monetization.

So what features are driving these improvements? Unlike many children’s games, apps within the Creative World subgenre typically offer more frequent IAPs as a way to build up the players world or buildings. Other games, like Kiddopia, offer various prices on subscriptions and full access to the app. Developers have worked to discover a variety of viable strategies within this genre.

Driving downloads has always been challenging for this genre. Marketing is complicated, with updated privacy guidelines, COPPA and younger demographics. Understanding how to advertise to parents is critical as they’re driving the decision for what their kids consume. The data.ai intelligence platform has the tools for developers to dig into the unique creative and ASO strategies necessary

App Performance Data available in Excel

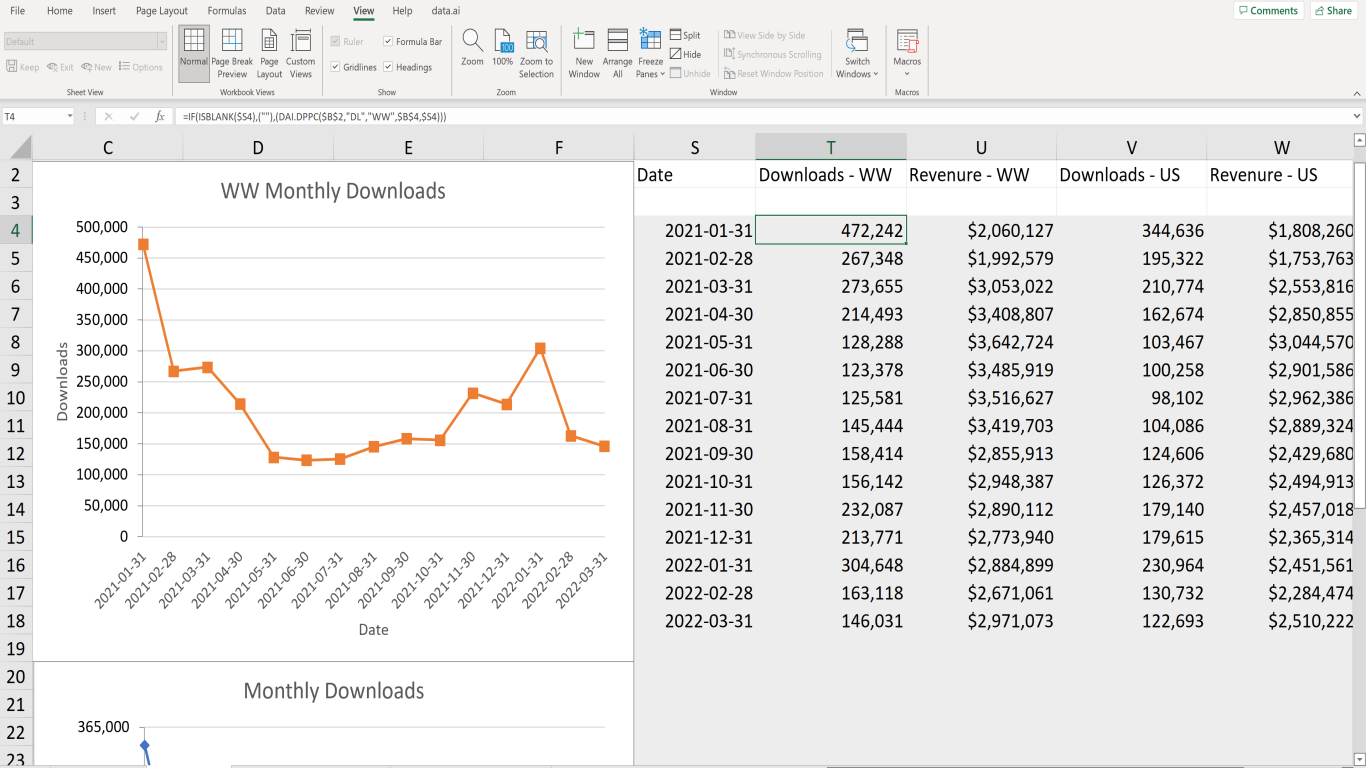

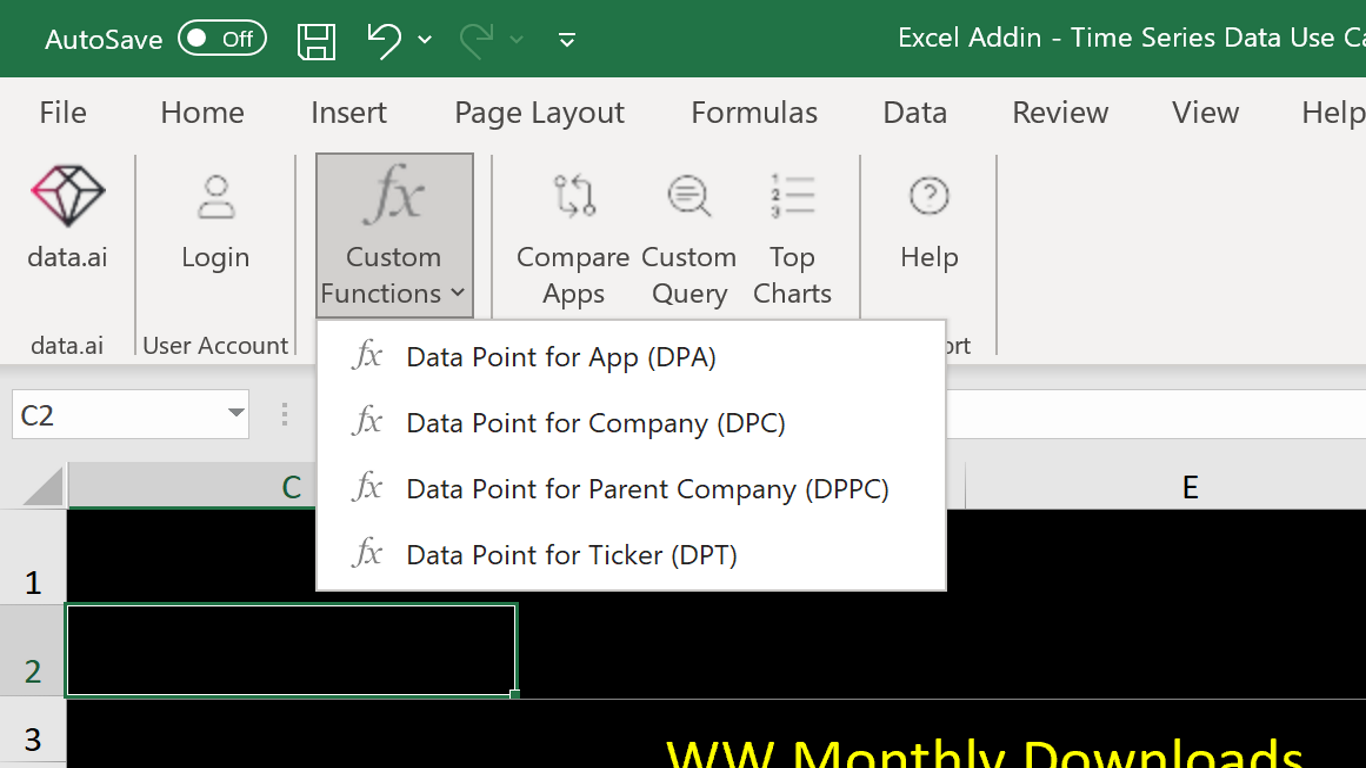

Our second innovation is that we have made our App Performance Data available directly in Excel, with no coding required. We know how important Excel is to developers’ day-to-day lives and what a crucial part it is of what you do to drive value at work. So we have made it infinitely easier for developers. By taking common use cases and user feedback, we have streamlined the process so developers can get straight to the juicy parts: analysis and insights, cutting out a number of tie-consuming steps along the way.

Our second innovation is that we have made our App Performance Data available directly in Excel, with no coding required. We know how important Excel is to developers’ day-to-day lives and what a crucial part it is of what you do to drive value at work. So we have made it infinitely easier for developers. By taking common use cases and user feedback, we have streamlined the process so developers can get straight to the juicy parts: analysis and insights, cutting out a number of tie-consuming steps along the way.

data.ai on Excel is our free, add-on data delivery solution for paid intelligence users that helps streamline commonly-used analysis workflows. This includes pulling a single metric into a single cell through automated Excel functions and macros. On top of that, you get series-based data directly from data.ai into your spreadsheet working file, with little to no manual work, so you can keep your spreadsheet in-sync with fresh data.

For example, let’s say you are a Product Manager or Market Researcher looking to monitor a set of apps within your company’s app portfolio. You might need data.ai app metrics in your own Excel file to upload into your own BI tool to process and merge with other data sets.

Using data.ai on Excel, you can pull data on your portfolio or your competitive set directly into your dashboard in an instant, on a daily, weekly, or monthly cadence. Jump straight into tracking trends or flagging market signals. If that wasn’t enough, data.ai on Excel also uses data.ai Excel formulas to format and refine the data so you can jump right into analysis. It also fetches the data for you without the need for coding skills. And it refreshes your preset data with the latest numbers at the click of a button. And it’s a free add-in for all paid intelligence users.

Using data.ai on Excel, you can pull data on your portfolio or your competitive set directly into your dashboard in an instant, on a daily, weekly, or monthly cadence. Jump straight into tracking trends or flagging market signals. If that wasn’t enough, data.ai on Excel also uses data.ai Excel formulas to format and refine the data so you can jump right into analysis. It also fetches the data for you without the need for coding skills. And it refreshes your preset data with the latest numbers at the click of a button. And it’s a free add-in for all paid intelligence users.

Cross App Affinity reports

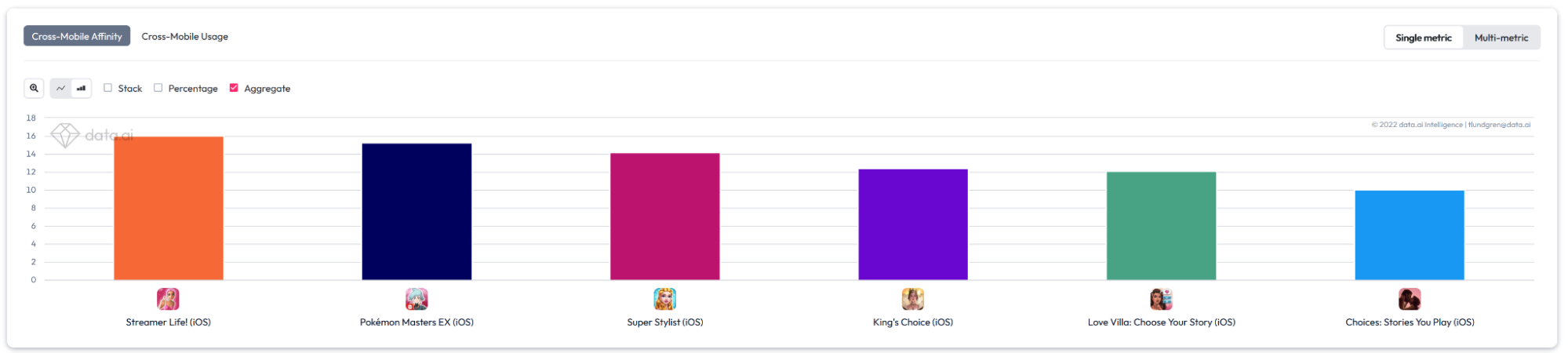

Our third innovation is the launch of Cross App Affinity reports, enabling developers to identify where their audience is spending their time.

As summer ends and we return to school or stay inside longer, the apps and games that we’re playing change as well. Students who suddenly have to prioritize their time spent on their phone are harder to convert into installers, and parents have a completely different set of responsibilities too. Speaking to potential new users in the right place at the right time becomes even more important as the weather cools down.

It’s no secret that privacy changes within the industry have shaken up the way marketing teams are able to do quality user acquisition. Over the past year and a half, advertisers have had to scramble to locate and acquire new users in an unfamiliar digital landscape. With advertising platforms having less insight into the quality of potential new users, previously consistent tools like Value and Purchase Optimization have become much more difficult to leverage. It’s up to marketing teams now to know who their target audience is and where to find them. Using the Cross App Affinity report provided by data.ai opens a whole world of insights into how a target audience is spending their time.

It’s no secret that privacy changes within the industry have shaken up the way marketing teams are able to do quality user acquisition. Over the past year and a half, advertisers have had to scramble to locate and acquire new users in an unfamiliar digital landscape. With advertising platforms having less insight into the quality of potential new users, previously consistent tools like Value and Purchase Optimization have become much more difficult to leverage. It’s up to marketing teams now to know who their target audience is and where to find them. Using the Cross App Affinity report provided by data.ai opens a whole world of insights into how a target audience is spending their time.

Finding new users

Using the Cross App Affinity report dashboard, developers can fully visualize where their users are spending their time – and most importantly, where to find more of them. Cross App Affinity gives you insight into how likely users of your app are to use a different app. Filter this report by category to locate key competitor apps within your genre who might be getting a disproportionate share of your user’s attention.

Additionally, expand beyond your own category to locate high overlap outside of your typical competition. Picking out successful apps with high overlap to your audience can be extremely informative for your messaging around key features that are important to your target demographic. App Store screenshots give you a peek into how competitor apps are presenting themselves to new users. Utilizing Cross App Affinity can give you a fuller picture of where your most valuable users are at when they’re not in your app and what’s important to them.

As you identify apps with a high overlap to your own, you can start to locate where your audience is when they’re not playing your game. Knowing where your audience is gives you a view into what your audience looks like. Putting together the apps with high affinity relative to yours shows you the type of messaging and features that could be most impactful in speaking to potential new downloads.

Once you’ve selected competitor apps, use the graph visualization to chart usage and affinity over time. Identifying apps that overlap heavily with yours, especially over a long period of time is a great way to build up new user acquisition strategies. The data around top networks and creatives for competitor apps can give you guidance on themes and features that are successful with users very similar to your own valuable players.

The ‘Advertising’ tool will even showcase the top performing networks your competitors are using to acquire users. Combining the internal knowledge of high monetizing features with data.ai’s insights into what is working at the market level points you towards the ideal marketing strategy.

Get the messaging right

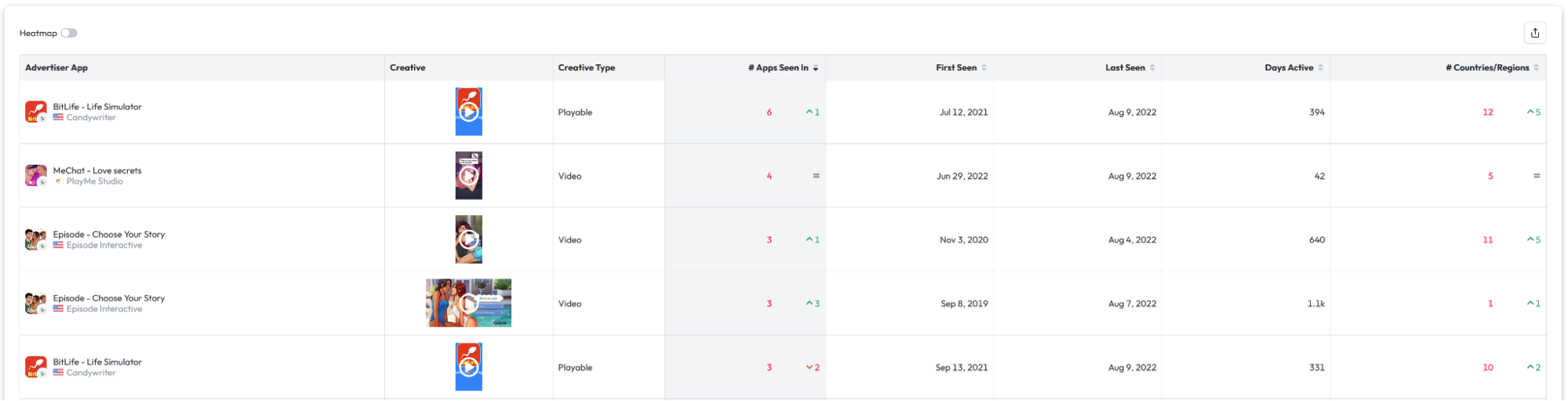

Knowing where users are spending their time and the networks used to acquire them is only a small piece of the puzzle. In the end, whether a user decides to install your app or not all comes down to the messaging. After you’ve consolidated your top affinity competitors and where they’re acquiring their users the next step is to see how they’re speaking to potential new users.

The Creative tool by itself can be extensive. Videos, banners and static ads from all over the globe across thousands of genres and subgenres are archived here and updated using impression data to analyze scale and success. Using the apps and networks that we’ve identified as high potential based on competitor usage will allow us to filter this view down to an extremely useful summary of what’s working for user acquisition.

Use the Creative view to analyze the assets your competitor apps are using and beyond that, which ones are creating success where it’s important to you. Digging into specific creative allows you to see which apps and geos those assets are showing in. Use the insights pulled from the Creative table to pick out the type of messaging that has been resonating with your target audience. Replicating themes that you see working is called ‘Fast-Follow’ and data.ai will allow you to follow the fastest and with confidence.

Use the Creative view to analyze the assets your competitor apps are using and beyond that, which ones are creating success where it’s important to you. Digging into specific creative allows you to see which apps and geos those assets are showing in. Use the insights pulled from the Creative table to pick out the type of messaging that has been resonating with your target audience. Replicating themes that you see working is called ‘Fast-Follow’ and data.ai will allow you to follow the fastest and with confidence.

Identifying your competitors is difficult. Use the Cross App Usage report to locate high affinity apps, showcasing where your messaging is most likely to be effective. The follow up question is why? What are your users engaging with in other apps and how can you use that to drive your growth?

With Game IQ you can put together a full picture of your competitors and what makes them successful. Our taxonomy solution makes discovering competitors easy, and using this enhanced functionality, you’ll be able to drill down on apps that are comparable to yours and identify where they’re driving success.

GameIQ gives you deeper breakdowns into genres and subgenres compared to the app store categories. This allows you to explore in-depth how games within your category line up with yours. It also presents an opportunity to see how apps outside of your vertical take unique approaches to monetization and engagement features. With data.ai’s game taxonomy breakdown you can get a jumpstart on highlighting the apps that you should be focusing on as competitors.

Game IQ also gives you breakdowns into the prevalent features within an app, showcasing what’s driving their success. Additionally, you can experience the First time user experience, or FTUE, for competitor apps as if you just downloaded it yourself.

Finally, use the Creative gallery to further optimize your analysis, giving you visibility into the themes and features that are used in the most successful creative assets. Combining the powerful, market level data with specific apps important to you is the ideal way to pull out actionable insights that will help drive growth for you. data.ai is in place to help make that more efficient.

You can find out more about all these innovations and many others here.