Marcus Hadfield, Chief Strategy Officer at Apadmi, looks at the tools and tactics available to bricks and mortar retailers to help them thrive, as shoppers return cautiously to physical stores.

As cautious optimism returns, it looks likely that most physical retail stores are now able to open for business. But how? And for who? And for how long?

As cautious optimism returns, it looks likely that most physical retail stores are now able to open for business. But how? And for who? And for how long?

COVID-19 has already seen off a few big names. Laura Ashley and Cath Kidston have gone, Carphone Warehouse announced the closure of all their shops, and Debenhams, Oasis and Warehouse were facing an uncertain future, which culminated in the announcement of their acquisition to Boohoo this morning.

The rise in online shopping has been claiming high-street scalps for more than a decade, and hurting many more. Lockdown, plus the challenging months ahead, will sadly finish some of them off. Swathes of customers have been forced to shift their behaviours – to delivery, or other sellers. For bricks-and-mortar-only businesses, the short-term effects have been disastrous.

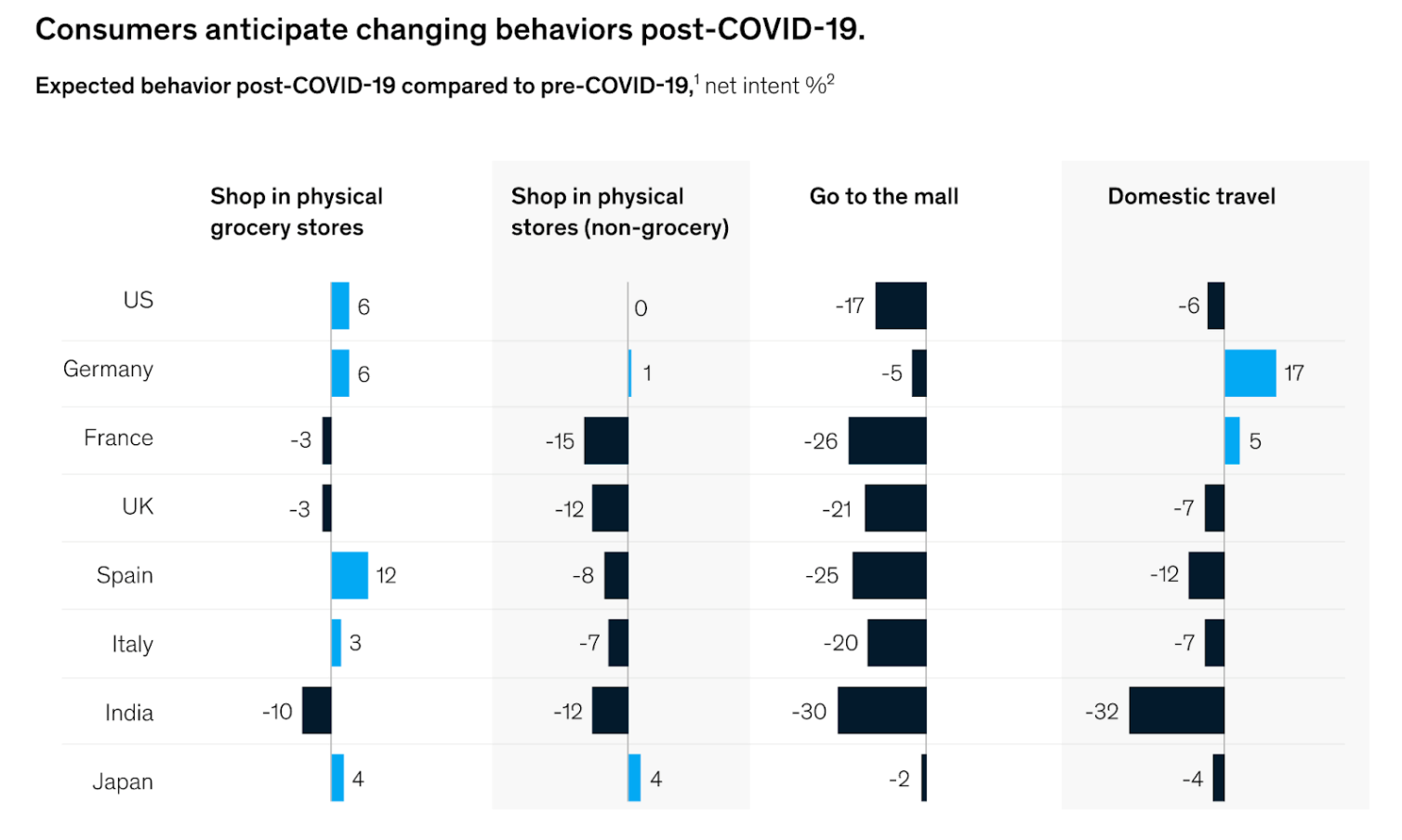

Unfortunately for them, according to a McKinsey report, not all these shifts will be reversed. As their chart below shows, UK shoppers are 21 per cent less likely to visit large malls, and 8 per cent less likely to visit stores post-virus. They refer to this as ‘post-lockdown stickiness’.

And those who do return to old ways will find new environments, with queues and rules, Perspex and plastic tape. Shopping will be slower and a bit more sterile for the foreseeable future.

And those who do return to old ways will find new environments, with queues and rules, Perspex and plastic tape. Shopping will be slower and a bit more sterile for the foreseeable future.

So – yet more growth for online and direct-to-consumer? Yes and no.

Online can’t do everything better, and in fact, currently one of its strongest tools (home delivery) is being tested by too much demand and too little fulfilment. Social distancing has been a big problem for warehouses too. Next, for example, had to shutter its online service as well for some time, forcing customers to go elsewhere.

And British people like to shop. Convenience still doesn’t trump experience – witness the queues outside the garden and hardware stores when they re-opened.

So, the good news is that there will be some survivors, and perhaps even some long-term winners. McKinsey refer to them as the ‘resilients’. The resilient retail businesses that innovate or take bold action to embrace the new ways of shopping and continue to thrive after the reopening.

So what are the challenges for the retailers who rely on physical stores for the bulk of their business? How can they overcome them? How can they be resilient?

1. Manage footfall

Social distancing is here for a while. Legally, for as long as advised by the government, and behaviourally, for a lot longer than that. So, as shops reopen, they won’t be as busy – and some customers may be put off by the perceived queues and hassle.

Smart retailers are already looking past the Perspex to new ways to get shoppers in and through, safely. Best Buy, the US electronics retailer is introducing ‘shopping by appointment’. Others are starting to explore queue management options, whereby people can join a virtual queue and be notified a few minutes before they can go in, rather than wait in line outside. Technology can quickly power these changes.

2. Distribute footfall

Taking things a step further, data-driven services can support a more proactive approach. Opening up live shopper data can allow prospective visitors to check that the store isn’t too busy before they set off. Rudimentary versions of this are starting to appear, like the Supermarket Check-In app but those who have retail resilience will need to own their own data, and deliver with more accuracy.

Historical data can build up patterns and predict business – opening up the opportunity to ‘flatten the curve’ (pun intended) of shoppers by promoting less busy times to visit – even incentivising those times through digital vouchers. In the hospitality sector especially, as it will be forced to reduce venue capacity, changing the shape of the week can help growth. Aldi have done this crudely – using Facebook ads to push quiet times – but there is a far bigger opportunity to push mobile messages to customers and drive their visits at times that are more beneficial to them, and to the store.

3. Be contactless

Contactless payments are nothing new – and even contactless scanners have been around for a while now, alongside self-checkouts. Sainsbury’s recently shifted the emphasis of its Smart Shopper app to focus on safety and hygiene, rather than the previous message of convenience.

But it’s not just about payment. Some customers won’t want to set foot in store – and actually this isn’t a bad thing, as it can help with the footfall challenges above. Again, simple mobile order and payment can build quick ‘Click & Collect’ services and meet that need. It’s exciting to see the speed at which such initiatives are being created and launched. Dunelm Mills rolled out a contactless service, whereby store staff delivered products to customers outside in their cars. Smart, fast thinking.

4. Maximise service

The advantage that bricks and mortar should always have over the web is customer service – so maintaining a key reason to attract visitors is important. John Lewis experimented with letting people book digital conversations with Virtual Assistants during lockdown – continuing that option to book a slot to seek advice, help or direction in the store will be a winner. Customers don’t want to hang around, so let them book before they come.

It’s expected that ROPO (research online, purchase offline) will continue to be a trend for some – especially those who want to get in and out quickly, so ensuring that the final questions and transactions can be pre-organised is a strong lever.

5. Minimise disappointment

Pre-COVID, according to Forrester, 31 per cent of shoppers chose to use Click & Collect to avoid disappointing store visits. You don’t have to be an analyst to conclude that this will be a bigger factor now.

Shopping trips are likely to be better researched and pre-planned, which means customers will be even more upset to ultimately discover that the item they came for isn’t on the shelves – especially if they’ve had to queue outside. This means that all bricks and mortar stores should do what they can to provide confidence of stock levels, even when they don’t have a Click & Collect service.

Delivering live stock availability can be complex, but there are simpler and faster ways to help, even without an up-to-the-minute warehousing solution. Our client B&M has a stock checker built into its app that gives shoppers a ‘traffic light’ measure of product levels to minimise disappointment.

Other retailers are informing customers through digital channels when new stock lands, driving footfall and maintaining demand.

6. Speed

There’s not much time to waste. The answer to most of these challenges is in the fast digitisation of processes and services. Pre-COVID-19 these decisions took time and consideration – but not any more. We’re now working with retail clients who want stuff next month – and we’re creating new ways to pick off the retail quick wins that can help them deliver it.

We call it Digital Impact. Instead of lengthy ‘transformation’ projects, Digital Impact identifies the immediate challenges and opportunities, and finds the fastest way to deliver the most effective solutions. We get a mixed team of experts – strategy, tech and design – and work with small teams of decision-makers within the retail business. Get in touch if you’d like to learn more.

Finally, let’s look to China. They were first to feel the force of COVID-19 and the first to emerge from it. Over there, department store basket sizes are still around 33 per cent smaller than before the crisis – something that analysts believe is a reflection of people’s reluctance to spend too long in crowded environments.

To ensure retail resilience, businesses need to counter this. Fast-tracking digital products is the best way to do it – even for bricks and mortar-only businesses.