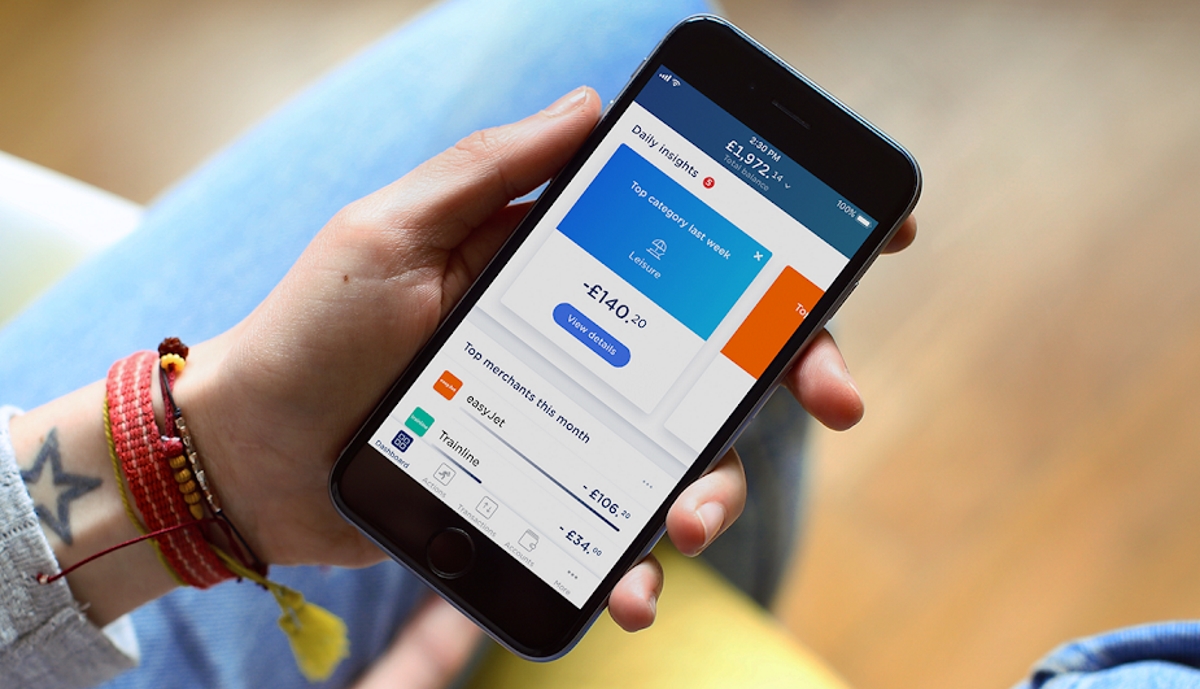

Money app Yolt has announced its first investment partner, Wealthify. The joint in-app integration will enable Wealthify customers to view their investments within the Yolt money app.

Money app Yolt has announced its first investment partner, Wealthify. The joint in-app integration will enable Wealthify customers to view their investments within the Yolt money app.

The news follows Yolt’s most recent announcement that it has attracted over 500,000 registered users. Building on the Open Banking ecosystem, Yolt says it wants to provide users with the ability to do more with their money across a variety of areas, including utilities and bills, financial products and leisure and experience. This latest announcement follows recent partnerships with pensions consolidation tool, PensionBee, home insurance platform, Homelyfe and life insurance adviser, Anorak.

“We’re delighted to announce our integration with Wealthify, offering our users an exciting option to view their investments alongside their other financial accounts and working towards our vision of becoming the only money app you need,” said Yolt CEO, Frank Jan Risseeuw. “We are excited to welcome our first investment partner to the app, providing users with seamless access to an investment tool, and look forward to working closely with Wealthify and our other partners to encourage a greater number of people tounthink money and empower them to do more with it.”

Michelle Pearce-Burke, co-founder & CIO at Wealthify, said that app-based, Open Banking architecture is one of the most significant and exciting developments in retail banking in the past 10 years and promises to bring transformational changes to the way people manage their finances day to day over the next decade.

“We fully support Yolt’s vision of the future of banking: effortless functionality, complete transparency and seamless access to top quality and relevant products and services, providing more choice and information to better enable consumers to make the right purchase decisions,” said Pearce-Burke. “Open Banking offers a game-changing level of accessibility to banking services that is akin to how our proposition is democratizing investing, by breaking down barriers and making information and choice ubiquitous.”